Legal & Tax Updates [Back to list]

SEC Grants Final Extension for Amnesty Applications Until 31 December 2023

The Securities and Exchange Commission (“SEC”) issued SEC Memorandum Circular No. 20 providing for the final extension to file amnesty application through the SEC Electronic Filing and Submission Tool (“eFAST”) and settle corresponding amnesty fees, until end of the year.

The SEC stated that despite the previous extension of deadline and enhancements to make the process easier, a number of applications remain incomplete due to lack of requirements. In consideration thereof and in line with its desire to afford businesses reasonable time and opportunity to be in good standing relative to their reportorial requirements, the SEC extends the deadline to signify their intent to apply for amnesty and settle corresponding amnesty fees until 31 December 2023. Thereafter, an updated scale of fines and penalties for the covered reportorial requirements shall be effective on 01 January 2024.

The SEC also issued notices on 17 October 2023 encouraging corporations whose Certificates of Incorporation have been deemed revoked for non-use of charter pursuant to Section 21 of the Revised Corporation Code (“RCC”) and those corporations placed under delinquent status for failing to file reportorial requirements pursuant to Section 11 of the RCC to avail the amnesty.

Submission of Reportorial Requirements

Non-compliant corporations and corporations whose Certificates of Incorporation have been suspended or revoked shall upload and submit their Audited Financial Statements (“AFS”) and General Information Sheet (“GIS”) until 31 January 2024. In addition to the AFS and GIS, corporations whose Certificates of Incorporation have been suspended or revoked shall also upload and submit their respective Petition to Lift Order of Suspension/Revocation via eFAST.

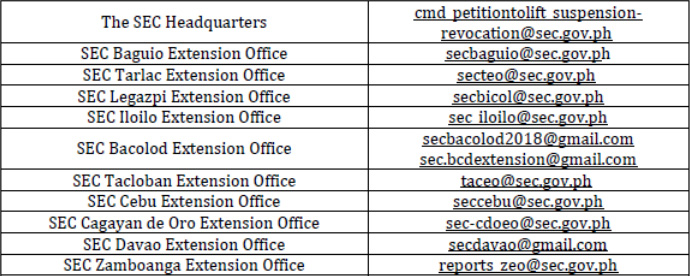

For corporations whose Certificates of Incorporation have been suspended or revoked, the following must also be submitted to the designated emails depending on their respective jurisdictions in support of their Petitions to Lift Order of Suspension/Revocation, no later than 31 January 2024:

- Directors’ or Trustees’ Certificate;

- Latest due AFS, as received by the SEC and Bureau of Internal Revenue (“BIR”);

- Latest due GIS, as received by the SEC;

- Copies of Certificate of Incorporation and latest Certificate of filing of Amended Articles or By-laws (if any) together with latest Articles of Incorporation and By-laws;

- Copy of registration of stock and transfer book or membership book;

- Secretary’s Certificate of No Intra Corporate Controversy;

- Sworn Certification by the External Auditor;

- Proof of ongoing operation, such as but not limited to:

- AFS;

- Income Tax Returns;

- Mayor’s or Business Permits;

- Contracts;

- Receipts showing payment of Real Estate Tax;

- Certification/Recognitions/Annual Conventions; or

- Any similar/related documents.

- Latest Mayor’s/Business Permit;

- BIR Certificate of Registration;

- Certification from the Corporate Secretary that the Latest Financial Statement and Income Tax Return was received by the SEC and BIR, respectively; and

- Compliance with SEC Memorandum Circular No. 28, Series of 2020.

Corporations whose Certificates of Incorporation have been suspended or revoked shall initially submit the digital copies of the aforementioned additional requirements to the SEC Company Registration and Monitoring Department or to the nearest SEC Extension Office through email:

Forfeiture of Amnesty and Filing Fees

Should an applicant-corporation fail to submit the complete set of requirements on or before 31 January 2024, the amnesty fee of PHP5,000.00 for non-compliant corporations and 50% of the total assessed penalties for suspended/revoked corporations, as well as the initial petition fee of PHP3,060.00 applicable to suspended/revoked corporations, shall be forfeited.

Refund of Overpayment

Refund of the amnesty fee for non-compliant corporations shall not be accommodated, except in highly meritorious cases, subject to existing accounting and auditing rules and regulations.